Economic Research

By Olivier Armantier, Gizem Koşar, Giorgio Topa, and Wilbert van der Klaauw

By Matteo Crosignani, Lina Han, Marco Macchiavelli, and André F. Silva

By Marco Cipriani, Daniel Fricke, Stefan Greppmair, Gabriele La Spada, and Karol Paludkiewicz

By Fulvia Fringuellotti and Saketh Prazad

By Cecilia Caglio and Adam Copeland

By Hyeyoon Jung, Robert Engle, Shan Ge, and Xuran Zeng

RESEARCH TOPICS

The mission of the Applied

Macroeconomics and Econometrics

Center (AMEC) is to provide intellectual

leadership in the central banking

community in the fields of macro and

applied econometrics.

Data Releases

Global Supply Chain Pressure Index

(Updated: Monthly)

Measuring the Natural Rate of Interest

(Updated: Quarterly)

Multivariate Core Trend Inflation

(Updated: Monthly)

The New York Fed DSGE Model

(Updated: Quarterly)

New York Fed Staff Nowcast

(Updated: Weekly)

Outlook-at-Risk

(Updated: Monthly)

Treasury Term Premia

(Updated: Daily)

Yield Curve as a Leading Indicator

(Updated: Monthly)

Data Releases

Global Supply Chain Pressure Index

(Updated: Monthly)

Measuring the Natural Rate of Interest

(Updated: Quarterly)

Multivariate Core Trend Inflation

(Updated: Monthly)

The New York Fed DSGE Model

(Updated: Quarterly)

New York Fed Staff Nowcast

(Updated: Weekly)

Outlook-at-Risk

(Updated: Monthly)

Treasury Term Premia

(Updated: Daily)

Yield Curve as a Leading Indicator

(Updated: Monthly)

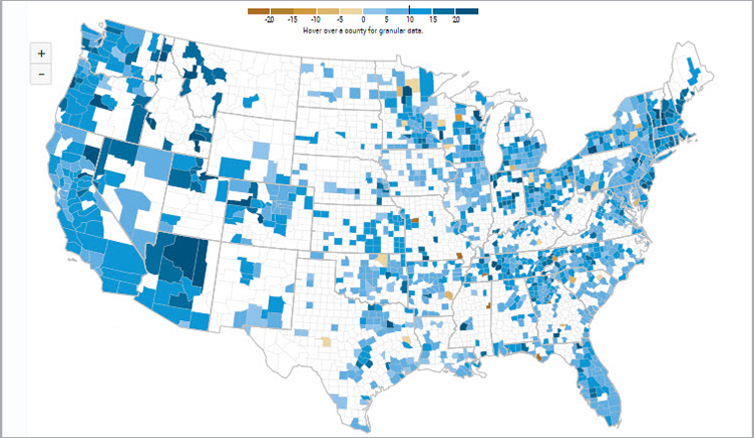

Monthly surveys conducted by the New York Fed track the sentiment of executives at regional manufacturing and service-sector firms regarding business conditions.

Data Releases

Empire State Manufacturing Survey

(Updated: Monthly)

Business Leaders Survey

(Updated: Monthly)

Supplemental Survey Report

(Updated: Quarterly)

Data Releases

Empire State Manufacturing Survey

(Updated: Monthly)

Business Leaders Survey

(Updated: Monthly)

Supplemental Survey Report

(Updated: Quarterly)

Richard Audoly, Rory McGee, Sergio Ocampo, and Gonzalo Paz-Pardo, Staff Report 1097, April 2024

Matteo Crosignani, Lina Han, Marco Macchiavelli, and André F. Silva, Staff Report 1096, April 2024

Natalia Fischl-Lanzoni, Martin Hiti, Nathan Kaplan, and Asani Sarkar, Staff Report 1095, April 2024

Nina Boyarchenko and Leonardo Elias, Staff Report 1094, March 2024

Keshav Dogra, Staff Report 1093, March 2024

Rachel Schuh, Staff Report 1092, March 2024

Claudia M. Buch and Linda S. Goldberg, Staff Report 1091, March 2024

Martín Almuzara and Víctor Sancibrián, Staff Report 1090, March 2024

Follow @NYFedResearch

Tools

Upcoming Events

People

Related New York Fed Content

Related External Content

By continuing to use our site, you agree to our Terms of Use and Privacy Statement. You can learn more about how we use cookies by reviewing our Privacy Statement.